Mark Anderson

Business Interruption consultant, Commercial Loss Management

Should professional firms - including accountants, lawyers and consultants - insure their revenue and fees? For many Professional Services businesses, it can be challenging to prove a permanent loss of revenue following an incident.

This article explores how the Alternative Index clause can be used to accurately measure and prove lost revenue; for example, measuring by chargeable time rather than turnover.

By way of “professional” firms/practices, as a generalisation, we are talking about businesses such as accountants, lawyers, insurance brokers, investment advisors, architects, and consultants. Separate to this group are the health professionals such as dentists, doctors, opticians, and physiotherapists. This is because some of them supply goods as well as their services, and Gross Profit cover may well be better suited to many of them.

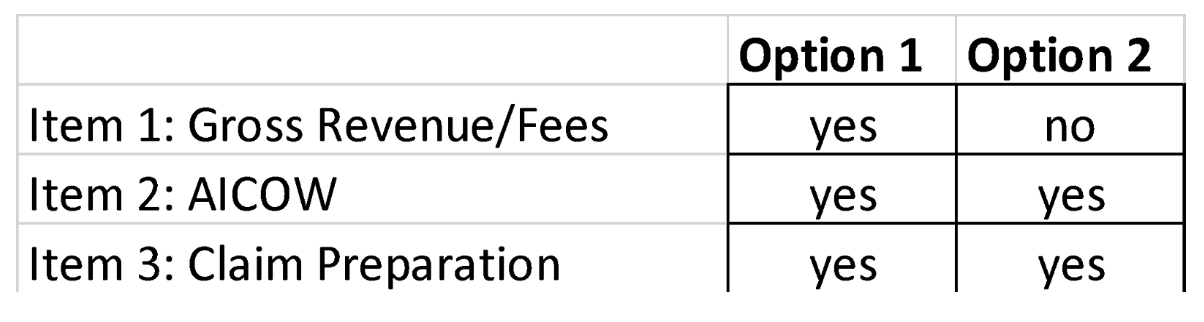

The two most common options we see that professional firms take business interruption cover are:

A common question we are asked by brokers is: should professional firms insure revenue/fees, or not?

The starting point is considering the fundamentals of business interruption insurance and cover for gross profit/ revenue/fees.

It provides cover for a “permanent” loss of turnover/ revenue/ fees and so businesses need to consider their exposures and risks to a permanent loss, compared with a “temporary or deferred” loss (and the revenue maintained at a later date) or simply no loss at all.

What exposure do professional firms have to suffering a permanent loss of revenue/fees?

To assist in the above, businesses can ask themselves what is their worst-case scenario and their ability to continue to earn revenue?

Destruction of premises requiring a long-term relocation, or permanent relocation

Ability to replicate existing premises elsewhere both as to required layout and space for staff.

Timeline to achieve the above.

Destruction and/or ability to access data, records, and information required to continue to function internally and externally.

With firms that record staff time (e.g. chargeable/productive time) what is the expectation that the disruption will have on chargeable/productive time? Our experience is that it is easy to underestimate the impact a disruption can have on productive time.

Our claims experience

From a claims perspective, we have been involved with a number of claims for professional firms over the last 25 years.

Some notable ones are listed below to illustrate some aspects where revenue was lost and paid under the business interruption policy.

The biggest challenge we have seen with claims for professional firms has been the issue of proving a permanent loss of revenue. Typically, the pushback has been “has the insured lost clients, or specific assignments and/or a reduced scope of engagement because of the incident” rather than just had a deferment of revenue i.e. the job/assignment has still been completed, but later than initially expected.

Also, from our experience reviewing revenue on a daily, weekly, or even monthly basis does not necessarily allow for an accurate measurement of lost revenue, simply because the nature of many professional firms is that their invoicing revolves around interim and final billings on assignments based on reaching specified milestones, rather than simply automatically billing each active job, for example, every month.

Business interruption policies generally include an “Alternative Index” clause (Footnote 1) which is shown at the end of this paper. This allows for measurements other than turnover to be used, for example, chargeable time, and often proves a more accurate measurement.

Auckland’s power crisis February/March 1998

We were involved with a number of significant claims for law and accounting firms that suffered loss of revenue out of this incident.

Points of note:

No physical damage to the insured’s premises but significant disruption due to the businesses relocating out of the CBD.

Many firms had staff working from home and/or were able to secure short-term premises for staff to work from.

Some challenges in showing the downturn in revenue, but reduced chargeable hours were used as the basis of the calculation and to underpin the proof of a permanent loss of revenue.

There were clear cases of reduced chargeable/productive hours, despite staff continuing to be paid their normal salaries.

The conclusions reached were that whilst difficult to show “lost” business, cancelled client assignments, the reality appeared to be that less chargeable time was ultimately charged to assignments, flowing through to reduced revenue.

Understandably much has changed with technology since this time with the likes of communication, cloud-based systems and no doubt a similar occurrence now would have very different outcomes to professional firms’ ability to work remotely, keep in contact with and service clients.

Law firm: Kaikoura earthquake November 2016

This firm was based in the Wellington region and its building suffered damage, resulting in no access for a number of weeks.

Points of note:

IT was not their strong point so struggled with access to client files which impacted on their productivity.

Some reliance on face to face meetings which were disrupted and also adversely impacted productivity.

Some challenges in showing the downturn in revenue, but reduced chargeable hours were used as the basis of the calculation and to underpin the permanent loss of revenue.

Architect firm: Kaikoura earthquake November 2016

This claim resulted from damage to a customer’s premises that the architect firm had just been engaged to undertake a sizeable assignment on. Ultimately the building was demolished due to earthquake damage and the firm lost in excess of $100,000 of fees.

Points of note:

This claim illustrated the importance of the often overlooked areas of the BI policy outside of the “damage at the premises”, which are often covered under Contingencies, or “Damage elsewhere”. E.g. Damage at customers or supplier’s premises, damage to transport routes, utilities, Acts of Civil Authorities.

Initially, it was considered that the assignment may just be delayed and potentially may not result in a permanent loss of fees, but with the demolition it was demonstrated that there was a permanent loss of fees. These were paid under the business interruption policy.

Summary

Some key aspects to consider:

Reduced productivity

Our experience with professional firms is that this is generally a key aspect to consider what impact a disruption will have on the firm's productive/ chargeable time.

In considering whether or not to insure Revenue, it will be worth also reflecting on how firms coped with the recent Covid-19 “lockdown” and what impact it has had on a firm's revenue. It may well provide an indicator as to how the firm could cope if it suffered a “worst-case scenario”, although somewhat complicated where revenue is also impacted by its customers' own challenges faced by Covid-19. Nonetheless, it is worth considering.Losses arising from “damage elsewhere”

Potentially a greater exposure to professional firms that rely heavily on any of the Contingencies, and as evidenced by the Architect firm, a significant claim arising from damage to one of its customer's premises.

With Customers and Suppliers, it is important to be clear on who the Customer or Supplier is, given there can often be intermediaries involved. E.g. If the Architect had been engaged by an intermediary that was carrying out the renovation, rather than being engaged by the building owner, the claim would have failed because it would not have been damage at the architect’s customer’s premises (the intermediary) that resulted in the loss of revenue.Requirement of cover for AICOW

Even where Revenue is insured it is recommended that cover be taken for AICOW. This is no different to businesses that have Gross Profit cover (E.g. retailers, manufacturers) and provides a backstop to costs that in the first instance would be claimed as an Increased Cost under the Gross Profit item. Costs that do not satisfy the criteria to be recovered under the gross Profit item are then considered under the AICOW item.